self employment tax deferral covid

Service Changes and Self-Service Options. Get a real estate tax adjustment after a catastrophic loss.

Deferred Social Security Tax Payments Due By Jan 3 2022

You do not need to complete another application.

. For a payment deferral. This meant that individuals who started self-employment for the first time in 201920 as a sole trader or partner in a partnership may have. Workers including the self-employed who are taking care of a family member who is sick with COVID-19 such as an elderly parent but do not qualify for EI sickness benefits.

Covid-19 and reasonable excuse. 100 of average pay at the employees regular rate. Low-income senior citizen Real Estate Tax freeze.

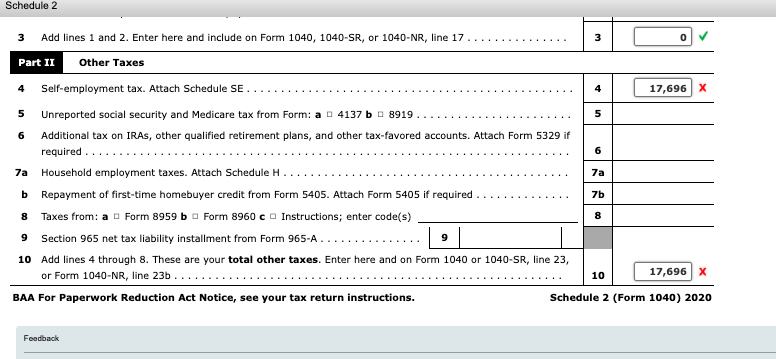

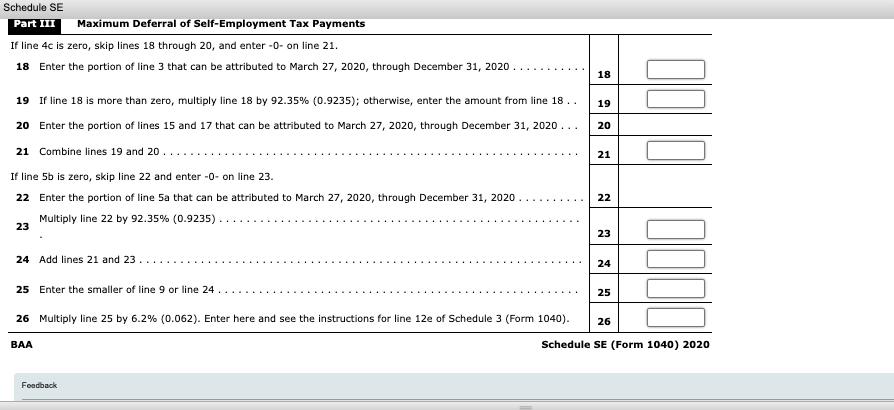

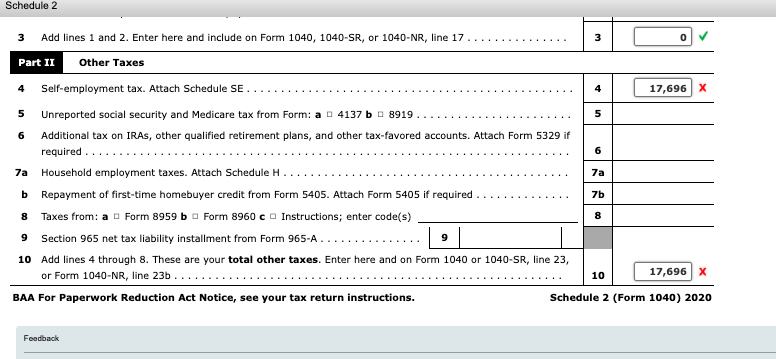

The Coronavirus Aid Relief and Economic Security Act CARES Act allows employers to defer the deposit and payment of the employers share of Social Security taxes and self-employed individuals to defer payment of certain self-employment taxes. Self-Employed defined as a return with a Schedule CC-EZ tax form. It must be reported on your 2021 to 2022 Self Assessment tax return.

10 of the taxpayers income from logging operations in BC or. The COVID-related Tax Relief Act of 2020 defers the due date for the withholding and payment of the employee share of social security tax until the period beginning on January 1 2021 and ending on December 31 2021. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

But if for example you had given details of self-employment. 150 of the federal logging credit that would be allowable before political contributions and investment tax credits. Additional support during COVID-19 Find out about additional support were offering to help you during this difficult time.

These FAQs address specific issues related to the deferral of deposit and payment of these employment. The tax credit for this leave is calculated using the lesser of. For each tax year a taxpayer must pay a tax equal to the lesser of.

While still subject to the FICA employment tax the deferred wage escapes current federal income tax. Seeking a medical diagnosis after experiencing COVID-19 related symptoms. Enroll in the Real Estate Tax deferral program.

Set up an Owner-occupied Real Estate Tax payment agreement OOPA Get a nonprofit real estate tax exemption. The Application for Homestead Tax Deferral is accepted by the Tax Collectors Office starting Nov. For more information about the deferral of employee social security tax see the.

The deadline to submit your 2021 Application for Homestead Tax Deferral has expired. You can register your business and get a City business tax account number using the Citys eFileePay website. Visit our website in October to obtain the 2022 Application for Homestead Tax Deferral.

Find out if youre able to claim for a Self-Employment Income Support Scheme. Set up a Real Estate Tax installment plan. See our Tax appeals page for more information.

1 and must be submitted by March 31 of the following year. Income Analysis Self-employment income is variable in nature and generally subject to changing market and economic conditions. Support for self-managed super funds Information on the support and relief available for SMSFs during COVID-19.

SEISS 4 and SEISS 5 grants. These policies remain effective for loans where the most recent tax return being used to document and support. Online competitor data is extrapolated from press releases and SEC filings.

For the fourth and fifth grants HMRC were able to take account of profit figures on 201920 tax returnsThe 201920 tax return must have been submitted by midnight on 2 March 2021. Whether a business is impacted by an adverse event such as COVID-19 and the. COVID-19 Self-employment Income.

Advised to self-quarantine due to COVID-19 by a health care provider. Most Department of Finance transactions can be conducted online rather than in person. Deferrals of harvesting in areas of old growth align with recommendation 6 of the independent panel reportThis page will.

Second it has an employee elective wage deferral that allows the employee to make a contribution of up to 15500 in 2008 or 100 of compensation whichever is lower. The Property Tax and Interest Deferral Program or PT AID allows eligible. You must have a City business tax account number to obtain CAL.

During the Covid-19 virus crisis private carriers that require a physical address eg FedEx UPS DHL etc can mail payment to. For 201920 Self Assessment tax returns HMRC said they would not charge the initial 100 late submission penalty provided the return was submitted online on or before 28 February 2021. 1 online tax filing solution for self-employed.

Parents with children who require care or supervision due to school or daycare closures and are unable to earn employment income irrespective of whether they qualify. To support the deferral process government will immediately cease advertising and sales of BC Timber Sales in the affected areas. Other paid sick leave options also exist but at a different pay rate.

If you applied for the business tax account number by mail that form will also be used to issue a CAL for your business. Support for tax professionals Find out about the range of practical support options we offer you and your clients.

News And Announcements Demian And Company Cpa

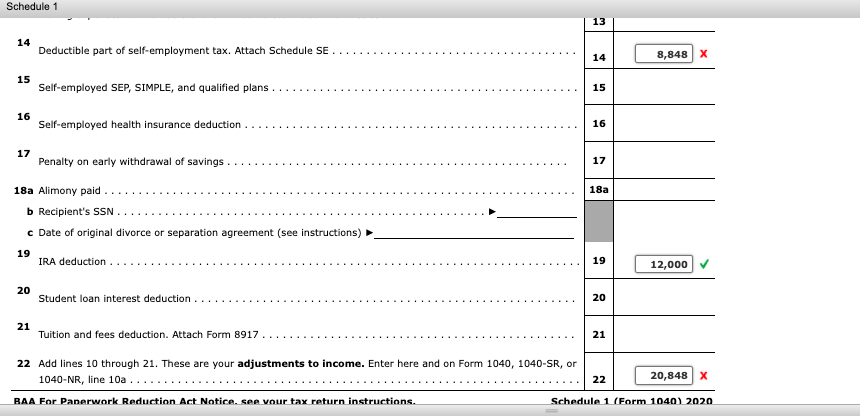

Note This Problem Is For The 2020 Tax Year David R Chegg Com

The Irs Announces That Income Tax Payments Due April 15 Can Be Deferred To July 15 Regardless Of The Amount Brown Edwards

Note This Problem Is For The 2020 Tax Year David R Chegg Com

What Is Form 4361 What Is It Used For The Pastor S Wallet

Self Employeds And Household Employers Process To Repay Deferred Social Security Tax Nstp

Control The Timing Of Income And Deductions To Your Tax Advantage Iannuzzi Manetta

Ffcra Cares Act Primepay Deliverables

Payroll Payroll Estate Planning Covid

July 2020 Tax Newsletter Covid Updates Basics Beyond

/GettyImages-92223836-57a5356b5f9b58974ab7e971.jpg)

Trump S Payroll Tax Deferral What Should You Do

What A Payroll Tax Deferral May Mean For Your Paycheck And Taxes

Cares Act Payroll Tax Deferrals And R D Credits

Note This Problem Is For The 2020 Tax Year David R Chegg Com